As tax advisors and accountants, we work hard to prepare your financial accounts and tax returns as accurately as possible. However, no one can control the Australian Taxation Office (ATO) or other government revenue authorities from randomly instigating audit activity on you or your business.

To maximise tax debt collection, the ATO has formed a Tax Avoidance Taskforce to ensure that many different types of Taxpayers are paying the correct amount of tax.

This can include an Audit of (but not limited to):

1. Businesses

2. Individuals

3. SMSF and other trust arrangements

4. Rental Properties

5. Work-Related Expenses

Who is the ATO targeting for audits?

WWhen an audit occurs, it is often the result of a specific crackdown through a variety of data matching or other artificial intelligence sources. These methodologies have proven to work very well, and there are no signs that the ATO or other government revenue authorities will ease up on them.

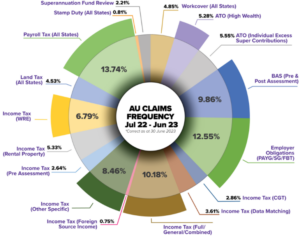

As accountants ourselves, we enjoy delving into the details of the numbers. This year, we have conducted a more comprehensive analysis of the distribution of claims noted by our claims department between 1 July 2022 – 30 June 2023.

Claims Activity

Our Audit Insurance partner, Audit Shield, reported that claims activity showed a general increase of 9% across all audit activity areas between 1 July 2022 – 30 June 2023 compared to 1 July 2021 – 30 June 2022.

The top areas on the rise noted by the claims team at Audit Shield were:

Payroll Tax Investigations:

Payroll Tax Investigations continue to be a significant focus area for all State Revenue Offices around Australia. There has been an overall increase of over 3.4% in Payroll Tax Investigations over the frequency in the 2021 – 2022 financial year.

Noteworthy statistics comparing 1 July 2022 – 30 June 2023 to 1 July 2021 – 30 June 2022 in specific states:

• VIC grew by 42%.

• WA grew by 84%.

• NSW grew by 462%.

• QLD dropped by 9%.

• SA grew by 75%.

Issues identified in Payroll Tax Investigations include grouping of related employer entities, contractors, employees based in other states, and employers not being registered when data (e.g., STP) shows they are over the Payroll Tax registration threshold.

Employer Obligations (PAYG/SG/FBT) Audits and Reviews:

Audits and reviews linked to employer obligations, including PAYG, SG, and FBT, continue to pose challenges for many businesses. The data indicates that Employer Obligations accounted for 12.55% of all claims, reflecting the complexity of compliance in this area.

Income Tax Audits and Reviews:

Income Tax audits and reviews continue to be a concern for taxpayers. While specific ATO audits may target certain areas, statistics show that Income Tax audits, in a broader sense, consistently feature among the top categories.

Other Significant Areas of Claims include:

• Superannuation Fund Reviews grew by 116%.

• Income Tax (WRE) Audits and Reviews grew by 26%.

• ATO (High Wealth) Audits and Reviews dropped by 18%.

• Income Tax (Rental Property) Audits and Reviews dropped by 35%.

How likely am I to be selected for audit activity?

Data matching has become more and more sophisticated each year. The introduction of Artificial Intelligence (AI) has made it easier and far more likely for taxpayers who have previously been untargeted to encounter an audit activity despite compliance. The ATO and other relevant government revenue authorities have unprecedented access to taxpayer records, allowing them to target previously unreviewed tax returns specifically. Now more than ever, you could be at risk of audit activity.

How can Morrows Help?

With audit activity on the rise, we believe it is an opportune time to offer our clients protection against unplanned professional fees that may arise due to audit activity. Keep an eye out for a special offer released in April. If you have any questions regarding audit protection, please contact with your Morrows advisor.

Want to learn to minimise your 2023 Tax Bill?

Our advisors have prepared two 2023 Tax Minimisation guides. These guides outline the various strategies we can consider to help reduce your personal or business tax bill this financial year. Fill in your details below, to gain access to these guides for free.