SMSF trustees now have until 31 January 2017 to ensure all LRBAs involving related party loans are within the “Safe Harbours” provided by the ATO. The ATO’s new guidelines aim to ensure all non-bank LRBAs are consistent with arm’s length dealing. Where loans are not within the “Safe Harbours”, the income derived from the asset may be classed as non-arm’s length income (NALI) and taxed at top marginal rates.

![safe-harbour[1]](https://www.morrows.com.au/wp-content/uploads/safe-harbour1.jpg) Morrows has the SMSF and legal expertise to assist those clients affected by these new guidelines and are currently implementing strategies to ensure compliance before the new deadline. Find out what action you need to take now.

Morrows has the SMSF and legal expertise to assist those clients affected by these new guidelines and are currently implementing strategies to ensure compliance before the new deadline. Find out what action you need to take now.

Specialist advice may be required for:

- SMSF trustees that have already entered into LRBAs; and

- SMSF trustees that are considering entering into LRBAs that are not financed by a bank.

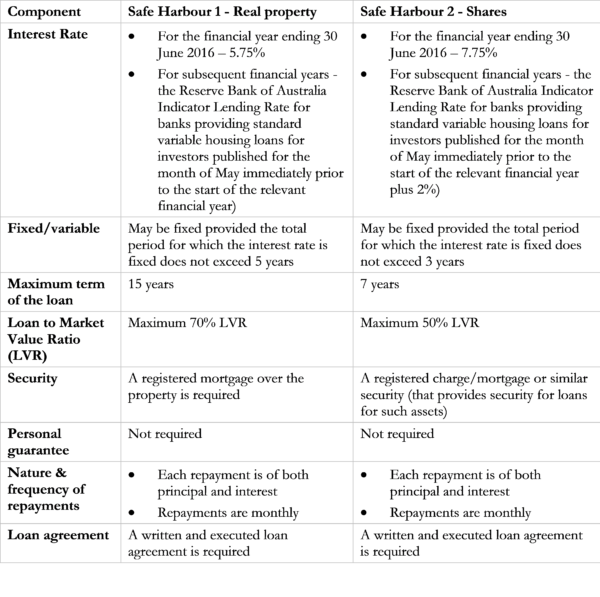

What are the Safe Harbours?

The ATO’s Practical Compliance Guidelines (PCG 2016/5) indicates that an arm’s length arrangement for the acquisition of real property would include the following terms:

What steps should be taken?

- Review of LRBAs involving related party loans to determine whether they come within the Safe Harbours.

- Where the terms of the LRBA are not within the Safe Harbours – amendment of the arrangement to bring it within the Safe Harbours.

- Retrospective adjustment for the current financial year to:

- Ensure that payments for the 2015-16 income year are consistent with the requirements of the Safe Harbours.

- Reduce LVRs.

- This may require making additional funds available for the SMSF via contributions, rollovers or asset sale to reduce the loan balance.

- These strategies would need to be undertaken and completed by 31 January 2017, making immediate action necessary if trustees are to comply.

What action do you need to take?

To mitigate the risk of income tax of 47% plus penalties and interest, Morrows will be working with those clients affected by these new guidelines over the coming months. However, we strongly recommend you contact us as soon as possible if you think your SMSF may have an LRBA that does not come within the Safe Harbours.

Please call Russell Krupp or Maureen Allan on 9690 5700 for assistance.