This week, our Labour Treasurer, Jim Chalmers, delivered Labour’s Federal Budget for 2023-24.

The Budget has had mixed reviews across the media and industry; with little support offered to small businesses with the main focus being on improving energy efficiency.

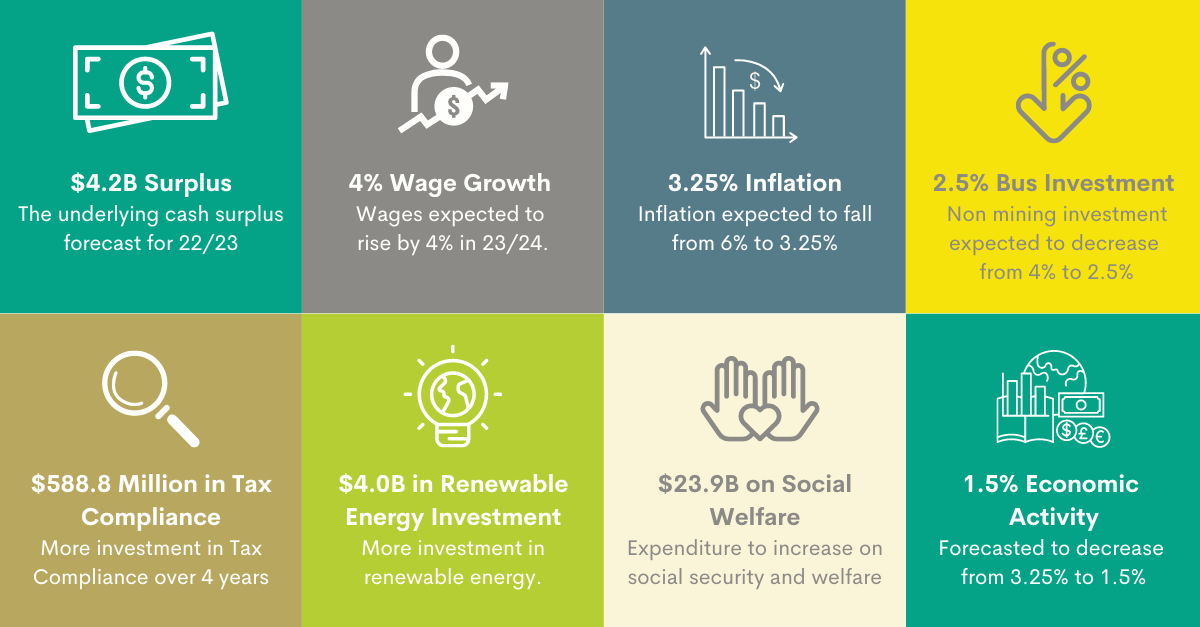

Before we explain the impact on Individuals and Small Businesses, here is a quick snapshot of the highlights and impact it is expected to have on the broader economy.

We have summarised the key takeaways for individuals, small business owners, and superannuation below.

Individuals and Families

- No Changes in Personal Income Tax Rates

- Increased Bulk Billing Incentives

- Personal Income Tax Compliance Programs

Business

- Small Business Instant Asset Write Off

- Small Business Energy Incentive

- Changes to PAYG Instalment system

- Small business lodgment penalty amnesty

- FBT Exemption to cease on Plug-in Hybrid Electric vehicles

Superannuation

- PayDay Super Guarantee Contributions

- 15% Super tax on balances over $3 Million

- Superannuation Tax Compliance Investment

3 Key Takeaways for Individuals

No Changes in Personal Income Tax Rates

The budget proposed no changes to the personal income tax rates for the 2022-23 income tax year, or for subsequent years.

Increased bulk-billing incentives

The Budget confirms that the Government will be investing $3.5 billion over 5 years from 2022‑23 to strengthen Medicare and make it cheaper and easier to see a doctor.

Tripling the incentive paid to GPs to bulk bill consultations for families with children under 16 years, pensioners and Commonwealth concession card holders.

Increase in Personal Income Tax Compliance Programs

The ATO will receive $89.6m and the Treasury $1.2m to extend its Personal Income Tax Compliance Program for another two years starting July 2023.

Further investing in systems that improve ATO communication and audit investigations, to better target individuals that are overclaiming and incorrectly reporting on income. The key focus areas of non-compliance include deductions relating to short-term rental properties such as holiday homes. They are estimating to collect an extra $475 million in additional tax revenue here, so if you have a holiday home that you rent out short term, be careful.

5 Key Takeaways for Small Business

Small Business Instant Asset Write Off

The budget includes a one-year small business instant asset write-off for assets up to $20k. The Government has announced a limited extension to the instant asset write-off threshold to $20,000, from 1 July 2023 to 30 June 2024. Instant asset write-off rules allow for an immediate deduction for the cost of a depreciating asset for small business entities.

This only applies to small businesses with an aggregated turnover of less than $10 million. To be eligible, the asset must be first used or installed and ready for use between 1 July 2023 and 30 June 2024.

Small Business Energy Incentive

The Government will provide an additional 20% deduction to encourage to switch to efficient energy sources. This applies to small businesses with a turnover of less than $50 million. The assets need to have been first used or installed and ready for use between 1 July 2023 and 30 June 2024.

The types of assets that the Government has stated will be eligible are electric heating or cooling systems, heat pumps, energy-efficient fridges, induction cooktops, and demand management assets such as batteries or thermal energy storage. Up to $100,000 of total expenditure will be eligible with a maximum deduction of $20,000.

Changes to PAYG instalment system

The Government also announced that the PAYG and GST instalments will be set at 6% (rather than 12%) for the 2023-24 income year to help provide some temporary tax instalment relief for business owners.

This will apply to small businesses, sole traders, and investors with up to $10 million in annual aggregated turnover for GST instalments and $50 million in annual aggregated turnover for PAYG instalments.

Small business lodgment penalty amnesty

The Government announced that a lodgment penalty amnesty program will be provided for small businesses with aggregate turnover of less than $10 million. This program is aimed to encourage small businesses to re-engage with the ATO. Any failure-to-lodge penalties from 1 June 2023 to 31 December 2023 that were originally due during the period from 1 December 2019 to 29 February 2022 will be waived.

FBT Exemption to cease on Plug-in Hybrid Electric vehicles

The Government has announced that from 1 April 2025, plug-in hybrid electric vehicles will cease to be eligible for the electric car FBT exemption. Arrangements involving plug-in hybrid electric cars entered into between 1 July 2022 and 31 March 2025 remain eligible for the electric car discount.

3 Key Takeaways for Superannuation

Pay Day super guarantee contributions

Employers will be required to pay compulsory super guarantee contributions on payday rather than quarterly (from 1 July 2026). This latest change has been introduced to help the ATO to better target and recover unpaid superannuation. The super guarantee is set at 11% from 1 July 2023 and is set to increase to 12% from 1 July 2024.

15% Superannuation tax on balances over $3 million

Future earnings on super balances over $3 million will be taxed at an additional 15% from 1 July 2025. The new tax has already received significant media coverage, we can confirm that the recent Budget announcement didn’t provide any further insight. So, at this stage, there is no rush to make any changes, let’s wait to see how this unfolds.

Super Tax Compliance Programs

ATO will receive additional resourcing of $40.2 million to help detect unpaid super payments earlier. It is estimated that $3.4 billion worth of super went unpaid in 2019-20.

Any Questions? Contact your advisor

Our Morrows One Team take a multidisciplinary approach to business and wealth, helping our clients align their strategic and personal goals. If you would like to discuss any details relating to the Federal Budget, please contact your advisor on 9690 5700.