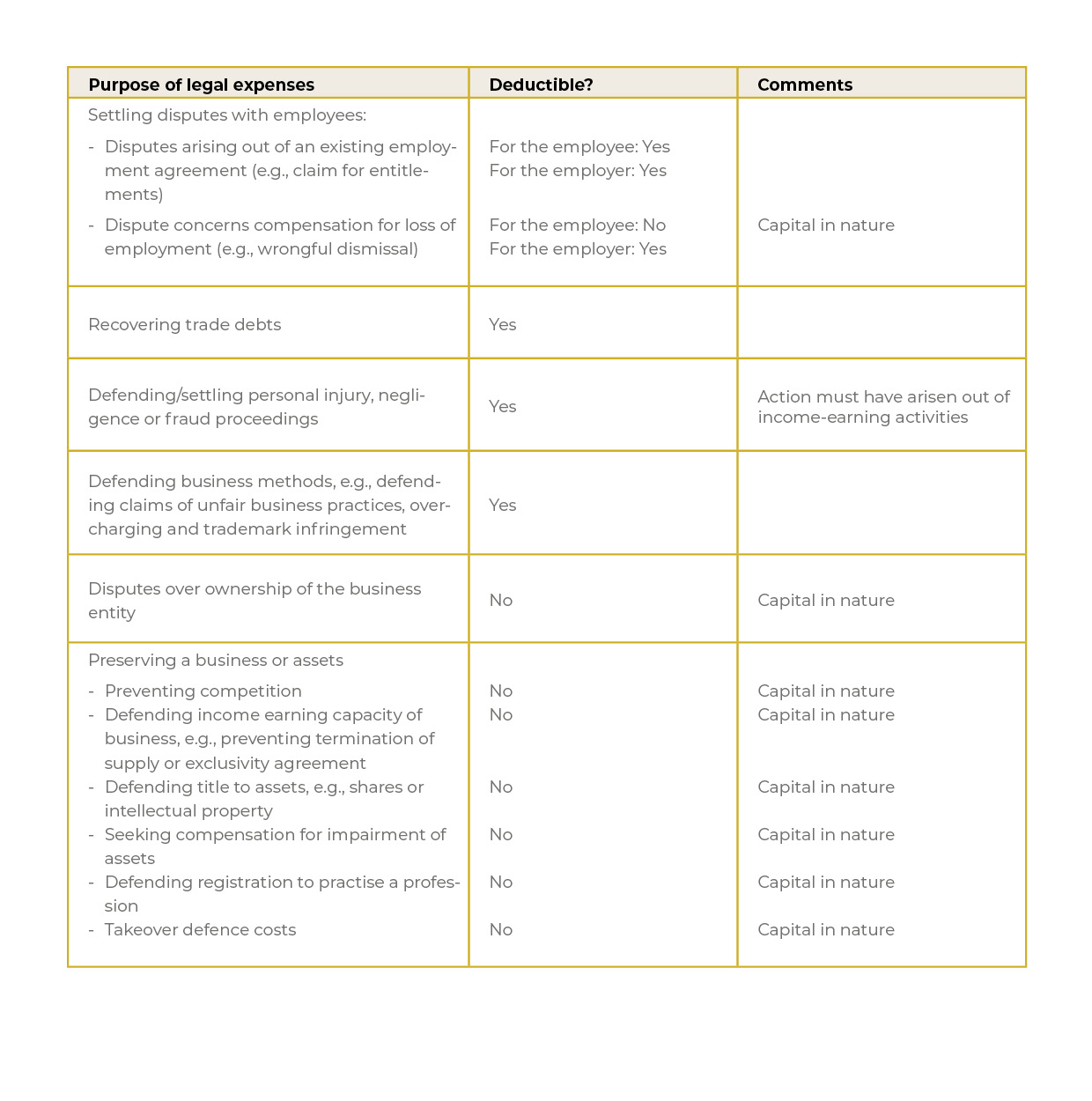

The deductibility of legal expenses is determined the same way as other business expenses. That is, they are necessarily incurred in earning your business income and are neither capital, private or domestic in nature.

This, in turn, has given rise to much dispute on what legal expenses can be claimed as a tax deduction. Understanding the character of the advantage sought by incurring on legal expenses is essential to assessing its deductibility.

Here’s what you need to know:

If you have any questions about the deductibility of legal fees, please get in touch with your Morrows Advisor.

If you have any questions about the deductibility of legal fees, please get in touch with your Morrows Advisor.