Australian wages in real terms are no different from where they were in 2012

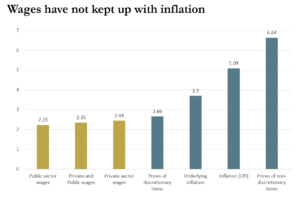

Feeling like your income is buying you less and less at the supermarket? You’re not alone. The most recent data from the Australian Bureau of Statistics (ABS) reveals that wages have increased by 2.4% on average over the last 12 months, while inflation (the increase in price of goods and services) has run at 5.1%, and as high as 6.6% for non-discretionary items. Food, petrol, healthcare and shelter all form part of the non-discretionary component on inflation, leaving you little opportunity to reduce your spending. This divergence between wages and inflation means that on average, Australian wages can buy less goods and services than 12 months ago.

|

|

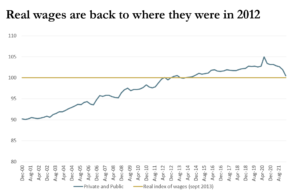

In fact, the chart on the right shows that real wages (wages adjusted for inflation) have fallen back to the level they were at in 2012, with the real wage growth from 2012 to 2020 entirely wiped out by the recent spike in inflation. Inflation is a tax on consumers and can have devastating impacts on economies and therefore interest rates will rise substantially over the coming months as most central banks, including the RBA, focus on reigning in inflation by reducing consumer’s appetite to borrow and spend.

So, what does this mean for you?

With inflation running hot and likely to stay elevated into 2023, it is time to focus on your costs and ensure your money is working as hard as possible to offset the negative effects of inflation.

How Morrows can help

Morrows Private Wealth’s Strategic Advisory team will help you understand and assess your financial situation and then formulate and implement investment strategies to suit your individual needs.

Now’s an ideal time to assess your investment approach and take the best action to achieve your financial and lifestyle goals. So reach out, and let’s start the conversation.