What comes up, must come down. What effect interest rates will have on housing prices.

Australians love property, and building a property portfolio is achievable for a great many of us. Decades of falling interest rates have helped many to build a property portfolio, often with a small deposit and a fairly large loan from a bank.

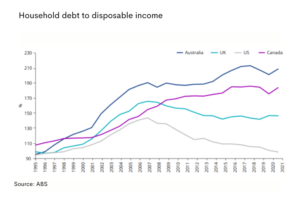

Household Debt to disposable Income (Chart 1)

In fact Australians love owning property this way so much that our households are now the most indebted country in the world compared to our disposable income (see chart 1). But what happens when the tide changes and interest rates increase? In 2019, the Reserve Bank of Australia (RBA), undertook this question and estimated the potential outcomes which we show below.

| Chart 1

|

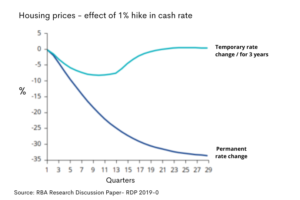

Chart 2  * Starting interest rate is not indicated * Starting interest rate is not indicated |

Housing prices- effect of a 1% hike in cash rate (Chart 2)

Chart 2 shows, the RBA estimated a one-percentage point (1%) increase in rates* (the starting interest rate is not included in the chart), if permanent, or perceived to be permanent, could result in a 30% fall in house prices and if temporary, or assumed to be temporary, could result in a 10% decline. Interest rates tend to move up and down in cycles, and in July the RBA raised the official cash rate to 1.35% in response to increasing inflation. That’s an increase of 1.25% since the beginning of 2022 and the highest level since 2016, implying we still have some way to go on up!

So, what does this mean for you?

While history should never be relied upon to forecast the future, the prospect of more interest rates increases means many will be closely watching the monthly RBA announcements and what it may mean for property prices going forward.

How Morrows can help

Morrows Private Wealth’s Strategic Advisory team will help you understand and assess your financial situation and then formulate and implement investment strategies to suit your individual needs.

Now’s an ideal time to discuss and assess your investment approach and take the best action to achieve your financial and lifestyle goals. So reach out, and let’s start the conversation.