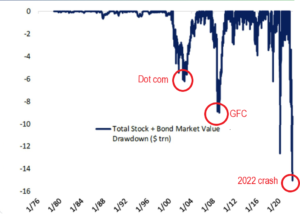

What happens when rising interest rates cause all asset classes to fall simultaneously? The largest destruction of wealth on record.

After years of low inflation and declining interest rates globally, investors experienced a sharp reversal in early 2022, with the highest inflation data in decades forcing central banks to begin quickly raising rates. Long term interest rates are integral to the valuation of all asset classes and as interest rates shot higher, investors quickly repriced risk, sending equity and bond values down sharply. Collectively, the fall in value of global stock and bond markets is the largest on record, with approximately USD$15.5 trillion in value wiped off these markets in only six months.

The largest destruction of wealth on record

Our Chart of the Month for August compares the recent fall to prior bear markets, with 2022 coming in at almost double the loss in wealth experienced in the GFC (USD$9 trillion in 2008/09) and more than two times the Dot Com Crash (USD$6 trillion in 2001/02)!

These prior two periods experienced major recessions, so should a deeper recession occur in the US by 2023 then we would expect these loss numbers to get even worse.

So, what does this mean for you?

The repricing of some unlisted assets is still flowing through into valuation models, with many larger institutions, including industry superannuation funds, slow to revalue their assets down to reflect the new economic conditions. Given these delays in pricing, we expect that the values of some portfolios are likely to reduce over the coming months until the full impact of higher interest rates is reflected across all asset classes.

How Morrows can help

Morrows Private Wealth’s Strategic Advisory team will help you understand and assess your financial situation and then formulate and implement investment strategies to suit your individual needs.

Now’s an ideal time to discuss and assess your investment approach and take the best action to achieve your financial and lifestyle goals. So reach out, and let’s start the conversation.