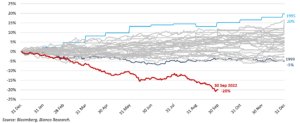

2022 is likely to set another record – the largest losses for bondholders in over 100 years! And it is not even close. To the end of September 2022, the Bloomberg Global Aggregate Bond Index has fallen approximately 20%, dwarfing the previous record of just under 5%.

Typically considered a safe-haven, bonds have fallen further than most growth assets this year, including the broad Australian shares index. This has been particularly painful for many conservative investors, who have been protecting their portfolios with a high weighting to bonds.

Bond prices are inversely related to interest rates, and the coordinated raising of interest rates by central banks across the world throughout 2022, has meant sharply lower bond values. And with global inflation remaining stubbornly high, most central banks are expected to continue raising rates until at least year end.

Bloomberg Global Aggregate Bond Index

Will we see further falls to an even larger record?

We might. Bond prices have already “priced in” further rate hikes, so substantial additional losses would require interest rate expectations to increase beyond current pricing. However, severe market declines provide opportunities for investors, and bonds are finally offering attractive yields after a decade of low returns. We expect bond holders to earn a much greater return over the coming decade than recent years.

How Morrows can help

Morrows Private Wealth’s Strategic Advisory team will help you understand and assess your financial situation and then formulate and implement investment strategies to suit your individual needs.

Now’s an ideal time to discuss and assess your investment approach and take the best action to achieve your financial and lifestyle goals. So, reach out, and let’s start the conversation.